reduction in time to verify a customer’s identity

saved by Moneyfarm’s Operations team per day

The challenge

Moneyfarm are a digital wealth manager offering a unique combination of simple investment advice and discretionary management. With their online platform and app, Moneyfarm combines human empathy and financial expertise with the efficiency of technology, to deliver cost-effective advice and investment solutions to every user.

Moneyfarm are one of the largest digital wealth management companies in Europe, regulated by the FCA, and also authorized by CONSOB to provide investment services in Italy. As a regulated entity, all Moneyfarm customers must complete AML and KYC checks before opening an account.

But restrictions with the Italian banking system meant customers had to wait around 3-10 days for the required verification and regulatory checks to complete. So the full process, from when customers opened an account to when they could start investing, took up to 4 weeks to complete.

Moneyfarm wanted to change this. They weren’t satisfied that the status quo was for customers to wait a minimum of 10 days to start trading. Investing money is an emotional process, and Moneyfarm knew it was key to maintain trust at the moment when customers are ready to invest. For many customers, this meant the option to self serve their investment journey with as few bottlenecks as possible. To help with this, Moneyfarm turned to Onfido.

The solution

Moneyfarm partnered with Onfido to build a smoother verification experience for their customers. Onfido were Moneyfarm's preferred choice for several reasons. Not only were we recognized as the market leader, but Onfido also met the regulatory requirements in the Italian market, as well as offering easy integration and extensive support services.

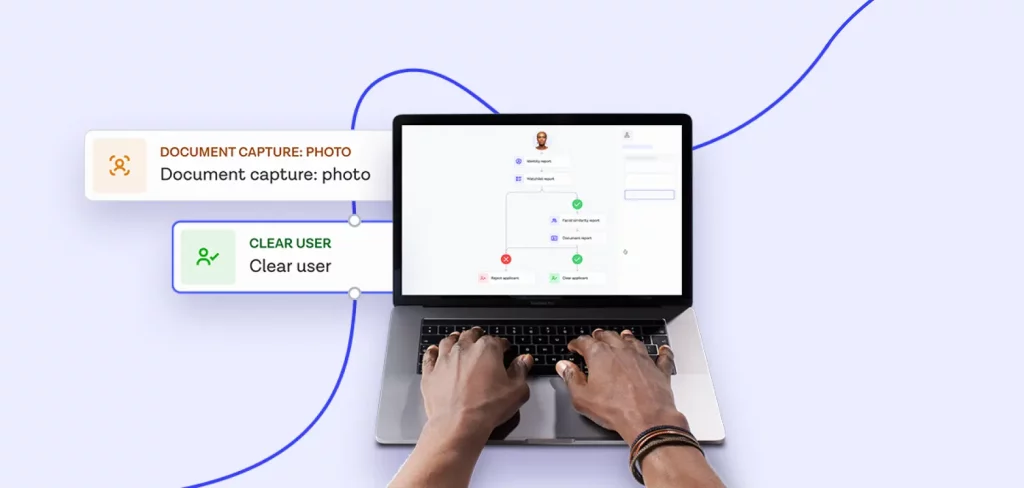

Moneyfarm are using Onfido’s Document and Biometric checks as part of a tiered-based system. Their aim is to auto-verify around 70% of customers through Onfido, while an internal Operations team reviews the other 30%.

Ross Godlonton, Head of Product, Moneyfarm

The results

With the help of Onfido, Moneyfarm are moving away from the ‘old world’ of legacy verification systems. By employing an automated approach, they’re giving legitimate customers instant gratification, enabling them to get into the platform and start investing, fast.

Customers no longer have to wait for up to 6.5 days to have their identity verified. With Onfido’s solution, identity verification takes just 5.8 minutes on average. This has helped reduce the entire account set-up process — from when customers open an account to when they can start investing — from three weeks to just four days. Customers are now much closer to getting that instant gratification and self-service investment experience.

Onfido are also helping to streamline Moneyfarm’s internal operations procedures, by meeting expectations of a 70/30 split on automation. Onfido checks are currently hitting a 70.48% first time pass rate, and there are plans to work together to optimise the process further. The Moneyfarm team thinks with Onfido’s help they can get closer to 80% automation.

With Onfido, Moneyfarm now gets a positive or negative on checks, fast. It's helped the Operations team get back the two hours a day previously spent on manual reviews, freeing up the teams’ time to focus on more value-adding parts of the process.

What's next for Moneyfarm? They're focused on improving their self-service offering even further, giving customers more transparency around money movement and reducing the time it takes for their money to arrive in their account. With Onfido, their overall goal is making what they do today as robust, scalable and accessible as possible. Find out more at moneyfarm.com.

About Moneyfarm

Moneyfarm are a digital wealth management company, born in 2012 in Italy and launched in 2016 in the UK. Their platform combines smart tech with the expertise of investment experts, offering customers the opportunity to grow their wealth with top-performing portfolios, a dedicated consultant and a smart app.