Automated KYC for financial services

Navigate KYC in financial services with an end-to-end identity solution. Satisfy global KYC and AML requirements by building tailored workflows that meet your unique requirements. Powered by award-winning Atlas™ AI, our verification experiences are seamless to reduce drop-off and grow your customer base.

32 account opening solutions profiled

Liminal’s Link™ Index profiles 32 leading vendors looking at momentum, market strength, stability, product scope, and leadership — finding only 21.3% of vendors meet buyer demands. Download the full report to get a complete view of the market challenges facing buyers, key purchasing decisions, and product demand criteria — and learn why Onfido is ranked as a global Market Leader, and a specific Regional Leader in Europe.

Digital transformation in banking

Know your customers

from day one

Verify identity while fulfilling KYC compliance obligations, meet ever-changing financial regulatory requirements, and protect your brand and bottom line. Unlock onboarding automation, fraud prevention, and digital transformation while mitigating sophisticated financial fraud.

Navigate compliance

Drive growth and scale

Reduce costs

Prevent fraud

How Onfido can help

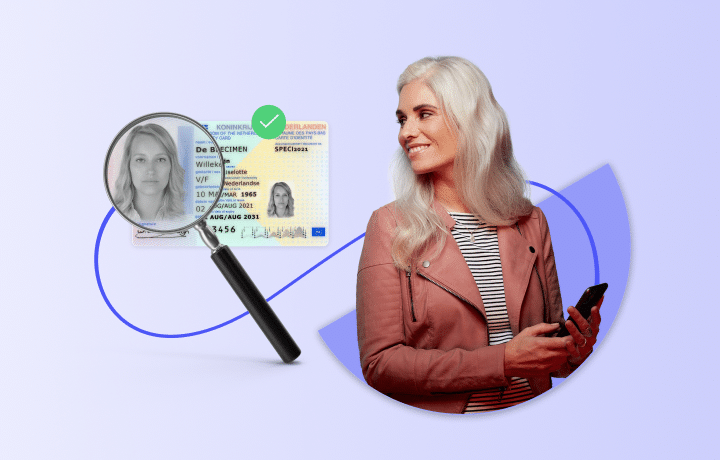

Document Verification

Have confidence in your customer’s identity by verifying a photo ID. Powered by Atlas™ AI, our Onfido document verification is fair, accurate, and delivers results in seconds.

Fraud Detection

Stop fraud without adding friction to the process. Introduce passive signals to your verification workflows to detect fraud without impacting user experience or turnaround times.

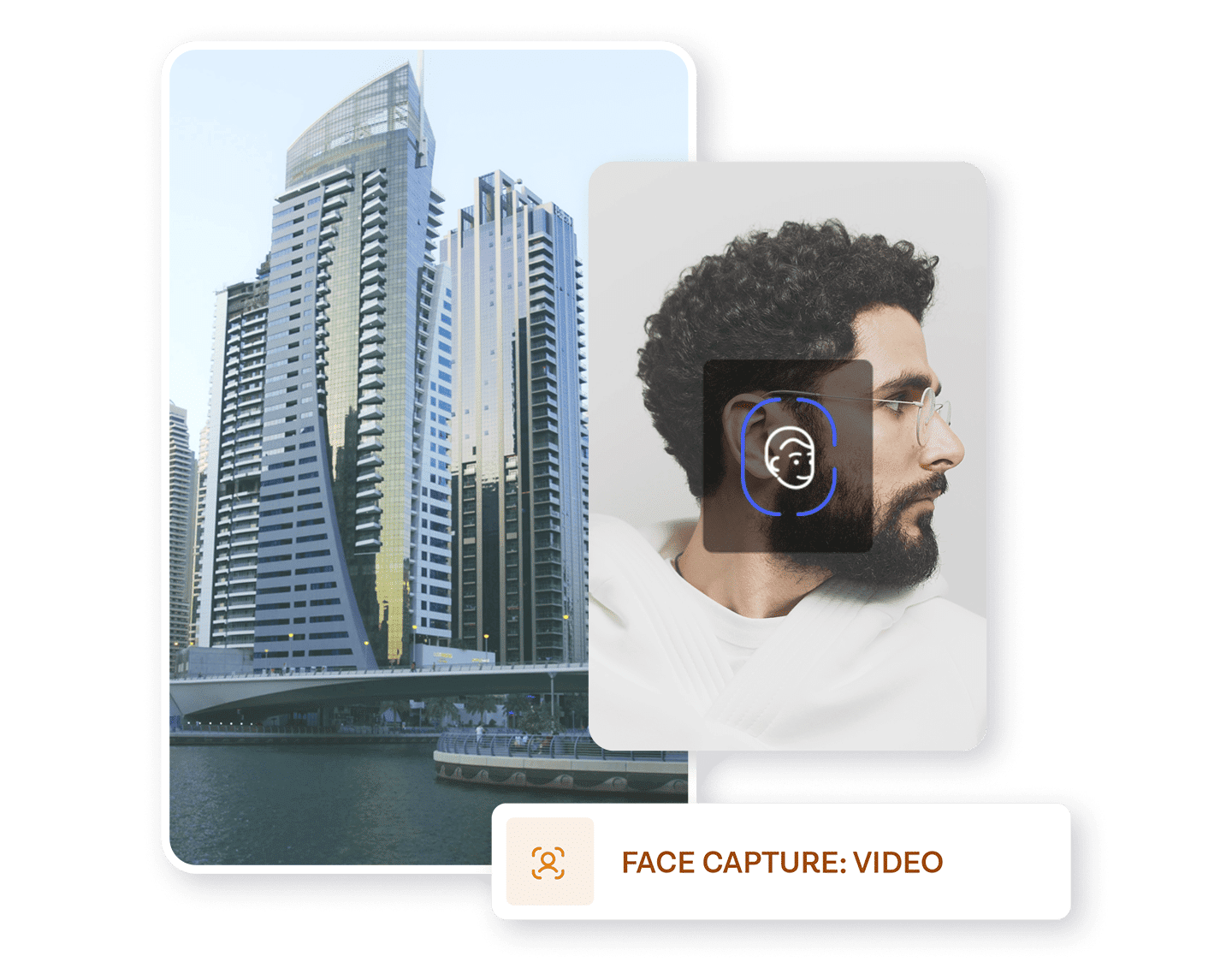

Biometric Verification

Build on document verification by connecting that ID to a real person. Onfido Selfie and Motion add another layer of fraud protection, while are a simple way for users to prove their identity.

Data Verification

Navigate complex global regulations with a range of trusted data sources. Choose and blend checks including ID record, watchlist monitoring, proof of address, AAMVA, and more.