Identity verification provider enables secure online payments at speed.

Onfido has partnered with leading global remittance platform, Remitly. Onfido’s AI technology helps Remitly swiftly onboard new users to its platform, without running the risk of fraud or financial crime.

Launched in 2011, Remitly is the largest independent digital remittance company in North America and is also available across twelve European territories, Canada and Australia. Remitly serves immigrant communities around the world by helping them transfer money internationally quickly and cost-efficiently; annually, over $6 billion is transferred through the platform.

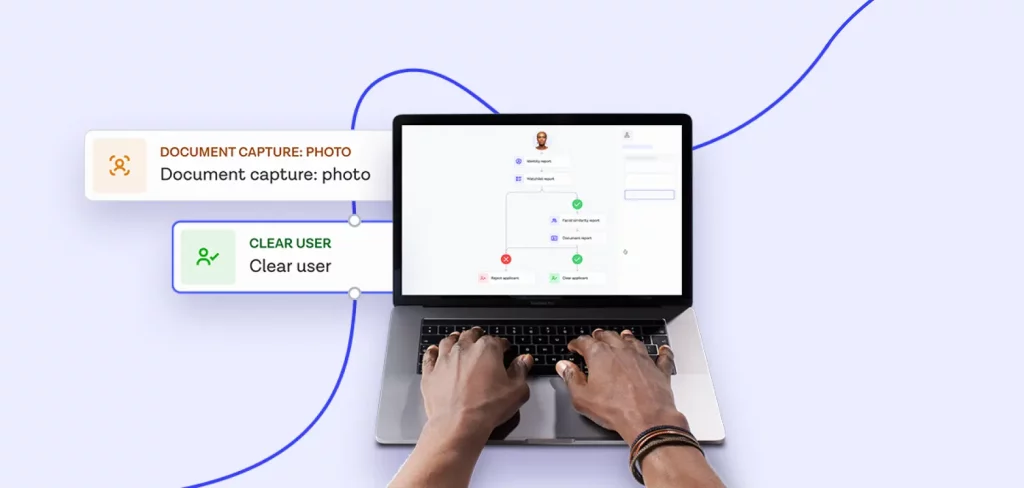

For Remitly, meeting compliance requirements without sacrificing the speed its users expect was key. Remitly chose to partner with Onfido to deliver frictionless ID record checks to its users around the world. Thanks to Onfido’s AI-based technology, KYC processes can now be rapidly completed for new users wishing to join the platform; for those requiring further assurance, a document check can also be performed. This cascade approach enables Remitly to scale to meet customer demand without compromising on either speed or security.

With users around the world accessing the platform every month, high pass rates were a deciding factor for Remitly. Onfido consistently outperformed other providers in this respect, resulting in less user drop-off and greater conversions for Remitly.

Nate Spanier, VP Global Payments and Expansion, Remitly

Husayn Kassai, CEO and co-founder of Onfido, said: “In a digital age, users need smooth, swift and secure access to services. But delivering that can be a challenge for financial businesses who are subject to complex regulations. We understand that challenge, and are very excited to be working with Remitly to deliver a frictionless experience to their users around the world.”

Improve onboarding conversion rates by deploying the right verification journey for every customer. The Real Identity Platform uses AI to help you automate onboarding without compromising fraud detection or creating compliance risks.