Proof of Address Verification

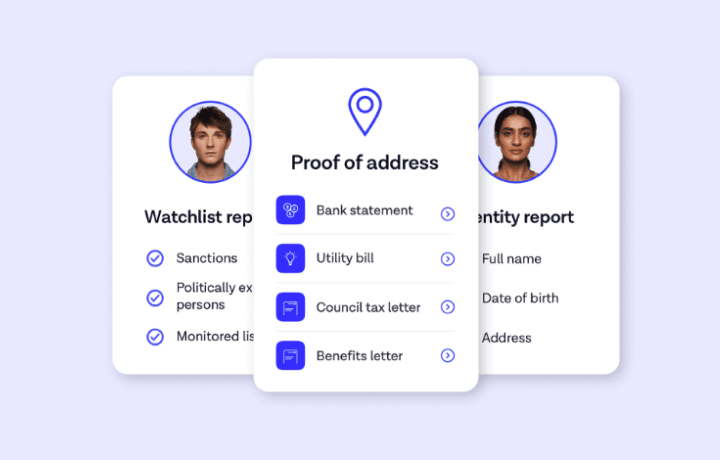

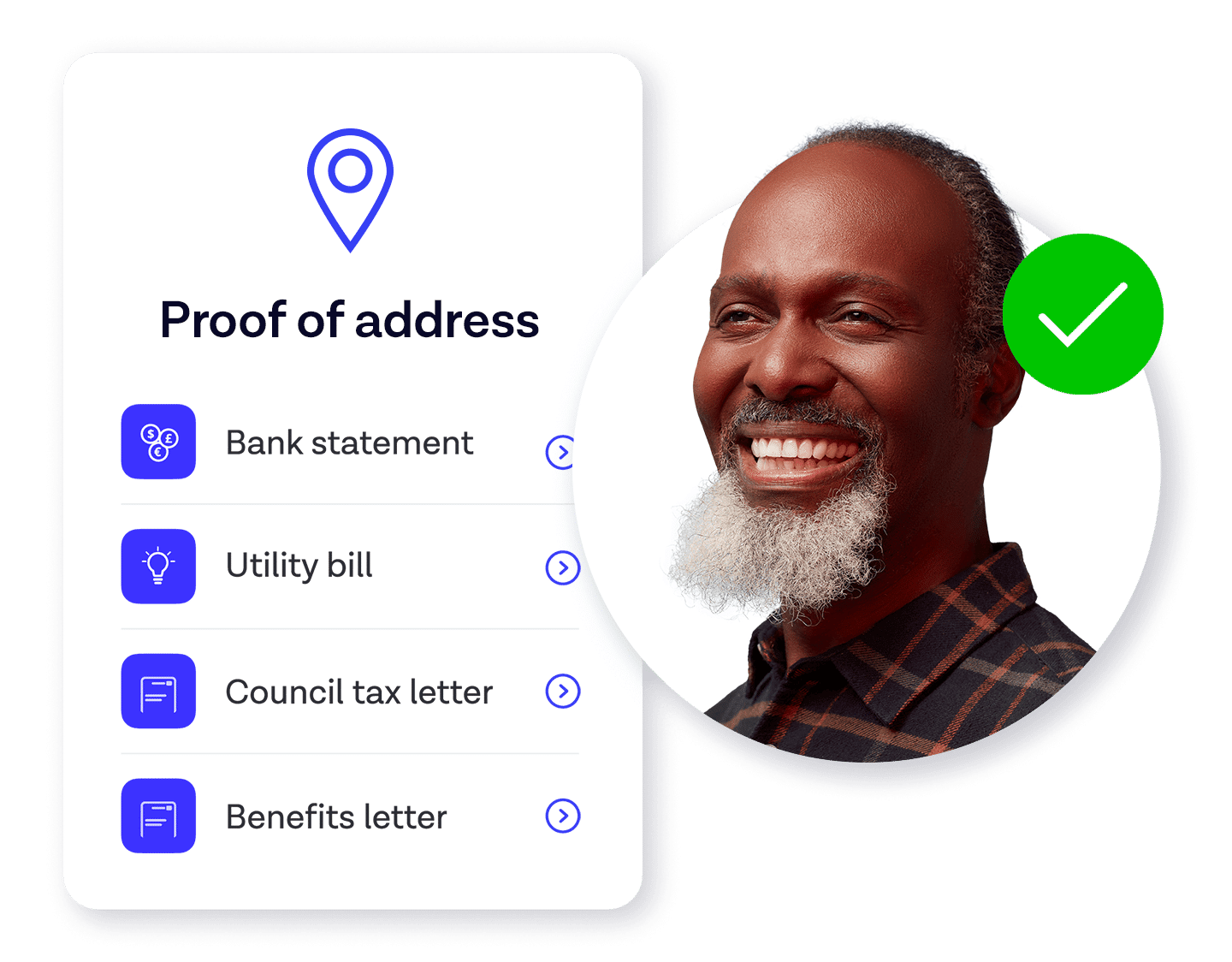

Enhance identity assurance with address verification. Onfido’s address verification solution helps you meet customer due diligence requirements by certifying PoA documents. Allow customers to verify their address online via mobile, desktop or across devices. All as part of one simple onboarding step.

Address verification service

Our automated address verification service makes the process seamless, secure, and simple for you and for your customers.

Navigate AML regulations

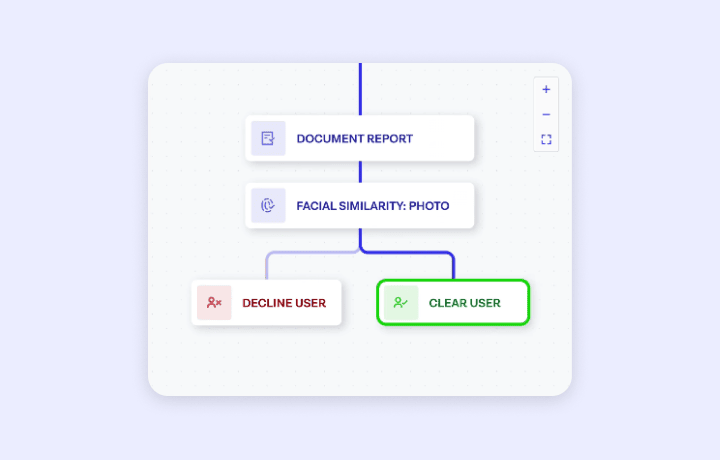

More easily meet KYC and AML compliance with automated address verification software at customer onboarding. Verify supported documents and combine address verification with other verifications and signals available in our verification suite to create compliant onboarding workflows.

Higher efficiency, lower costs

Swap manual, inefficient, time-intensive processes for an automated address verification service. Onfido’s Proof of Address report allows you to perform necessary checks as part of your existing digital verification process. We scale to meet demand, so you don’t need to build large teams to enable growth.

Build trust and confidence

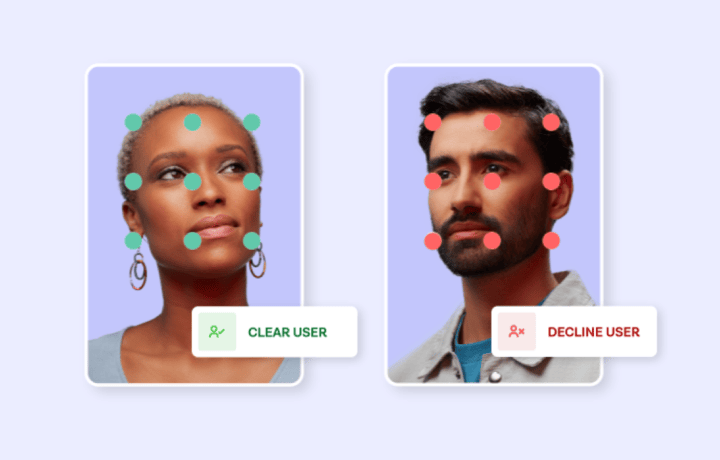

Onfido’s address verification software offers best-in-class analysis of submitted documents to assure document integrity and a verified address match with the applicant.

Our partnership with Onfido allowed us to verify our users twice as fast as before, and remain compliant with regulations and law — which is the most important thing in our business, as well as making the verification process even more smooth for users.

Daumantas Barauskas, COO, Genome

Read Genome case studyExplore the Real Identity Platform

FAQs

A fundamental requirement of know your customer (KYC) laws is proof of address verification. It works as a part of a company's larger anti-money laundering (AML) programme, which helps to improve security and stop financial crime and fraud. Regulated organisations must conduct customer due diligence on everyone they do business with in order to comply with KYC/AML compliance. This includes confirming one's identification, which almost always entails providing proof of one's residence.

Learn more in our guide to proof of address.

Onfido supports the following address verification documents:

- Bank Statement or Building Society Statement (issued within the last 3 months)

- Utility Bill including electricity, water, gas, broadband, landline (issued within the last 3 months)

Onfido supports these documents for the countries listed below:

- United Kingdom

- European Economic Area (excluding Greece, Cyprus and Bulgaria)

- United States of America

- Canada

- New Zealand

- Australia

- Hong Kong

- Singapore

- Philippines

- Indonesia

- Vietnam

- Mexico

- Brazil

- Argentina

- Ghana

- Ivory Coast

- Kenya

- Nigeria

- Senegal

- South Africa

- Tanzania

- Uganda

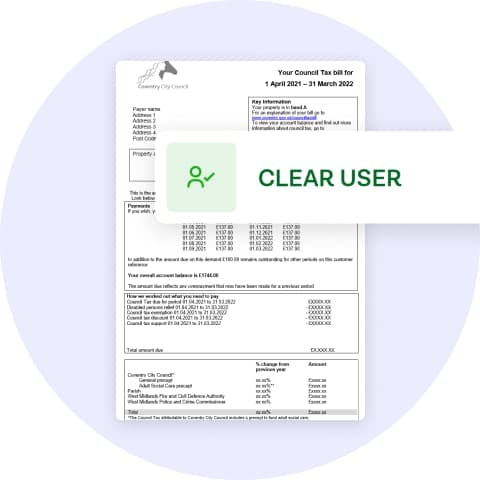

Additionally for the UK, we also support Council Tax letters and Benefits Letters (e.g. Job seeker allowance, House benefits, Tax credits) issued within the last year.

For more information, see the full list of address verification supported documents.

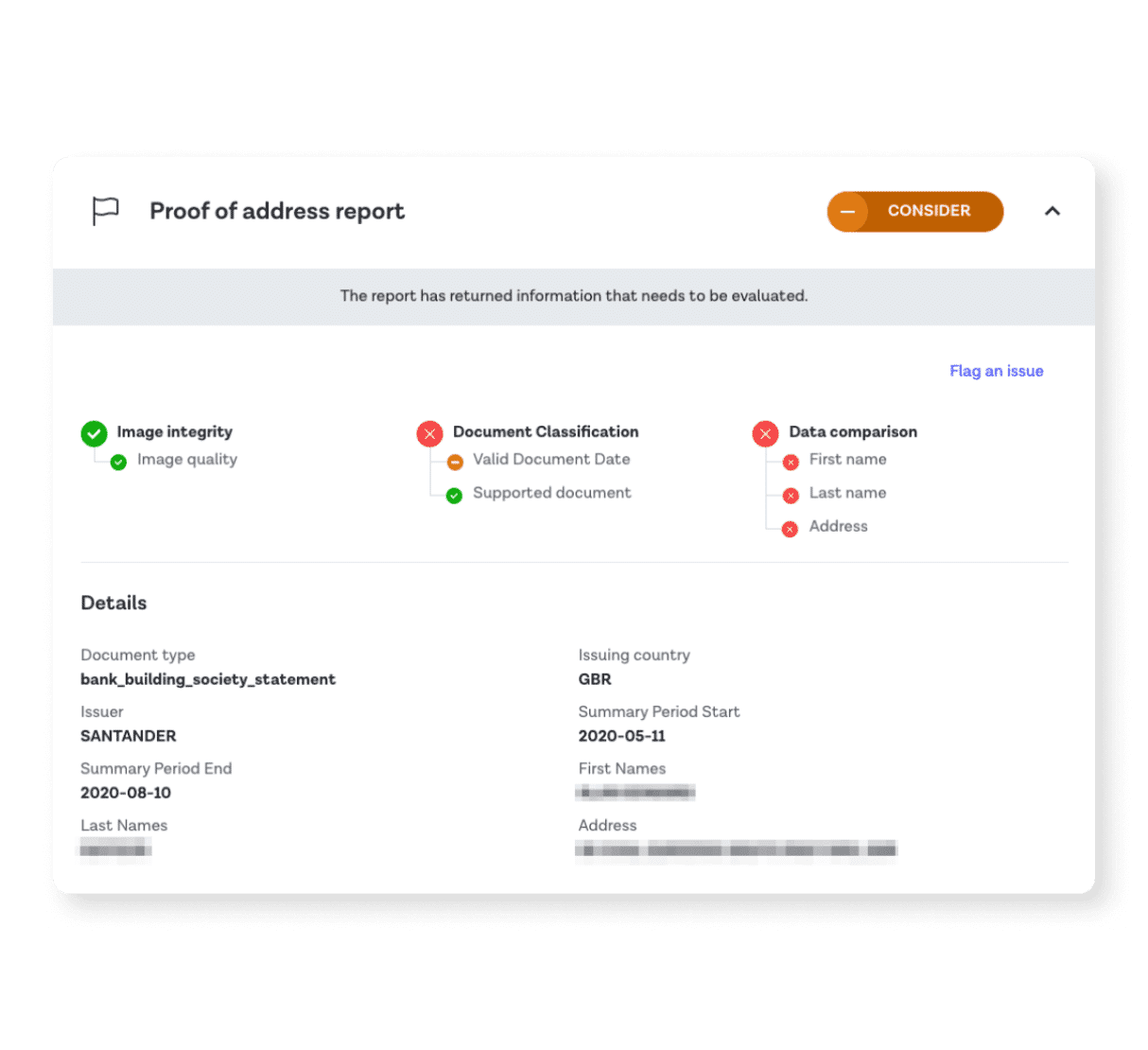

You will receive an address verification result once a user has captured and uploaded a supported document using the Onfido SDKs, or directly via the API.

The proof of address report checks whether the user’s information matches that on the document, and that the document has a valid date of issue.

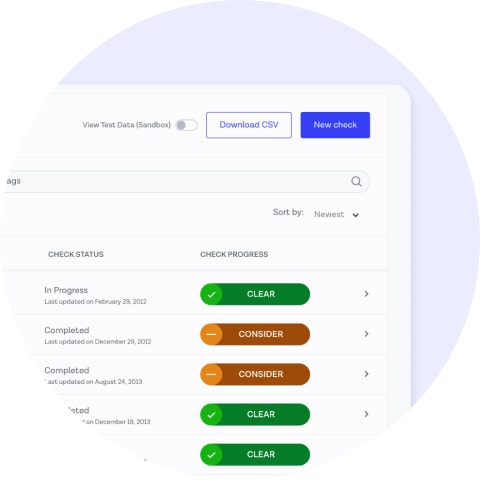

The report will return one of three results in the dashboard:

- Clear: No issues detected, the user may proceed

- Consider: There may be some issue with the document (for example it is the wrong type of document)

- Null: The PoA document is from an unsupported country

Need technical support? Find out more about our proof of address report and results.

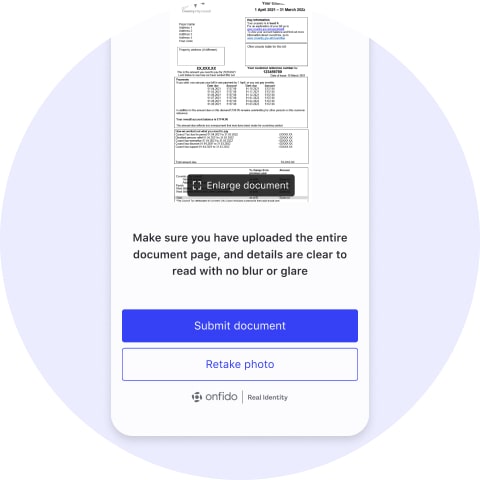

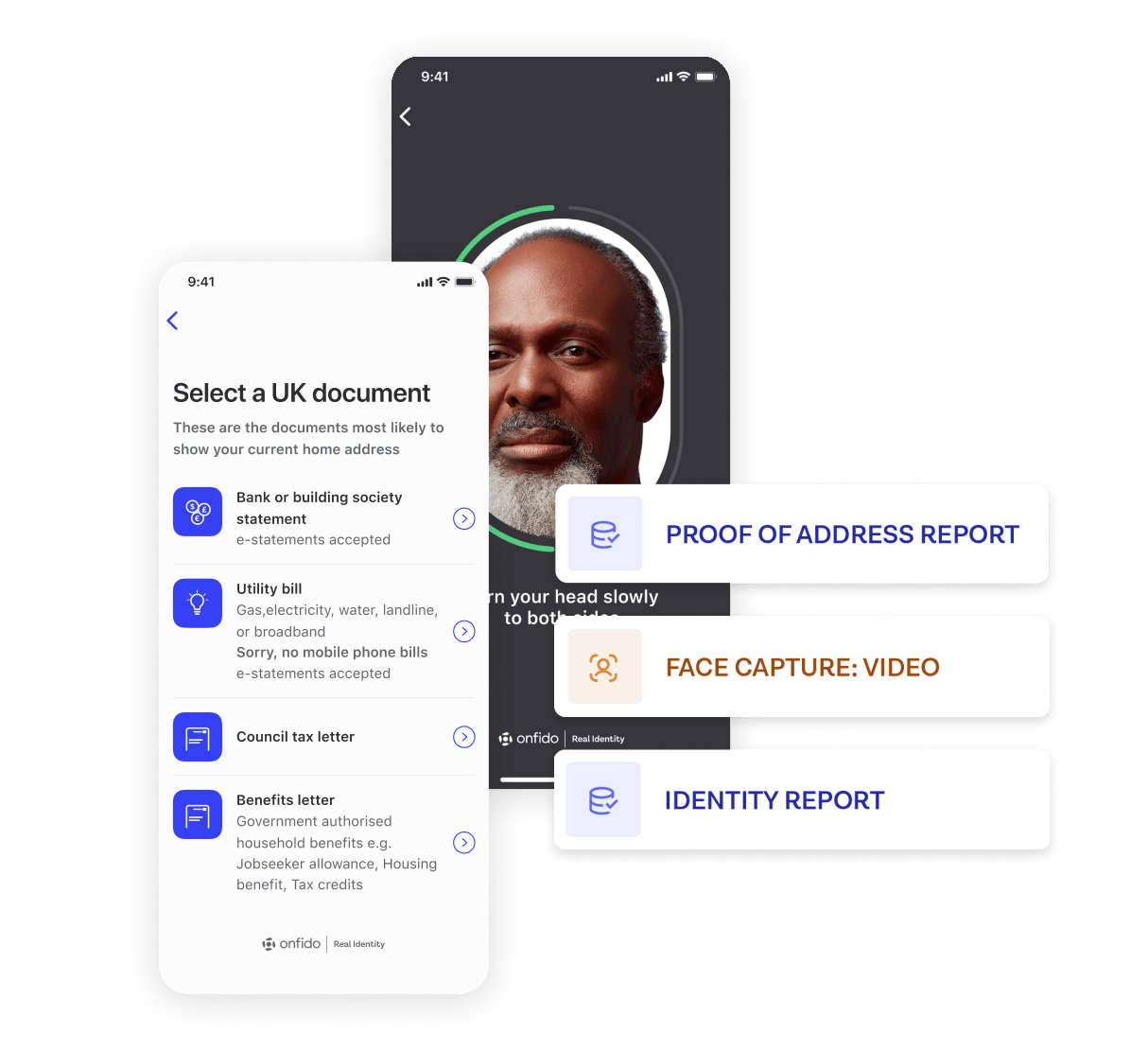

Users capture documents as part of a business’s onboarding flow.

- A user starts the onboarding process, providing the necessary information.

- When they come to complete the check, the user takes a photo of their PoA document using their smartphone.

- On the back end, Onfido’s address verification software analyzes the document and returns a result: clear, consider or null.

- If the result is clear, the user can continue to the next part of their application, or they might be asked to resubmit a different (supported) PoA document.

For more information about the document capture experiences, take a look at our Smart Capture SDK.